Enable Superior Digital Experience with Banking Chatbot

Deliver personalized banking experience to all your customers 24/7 with Banking AI Chatbots. And, quickly resolve queries without making the customer put up with a long wait in support calls.

- 24/7 Automated Customer Support for quick problem solving

- Quick Customer Onboarding by assisting them in registration and authentication process

- Personalized Marketing with by driving personalized promotions and engagement in real time

Banking Customer Service Automation

Give your customers a better banking experience with AI-powered banking support. With APPS AI Banking Bot you can now increase the quality of customer support without frittering away time into redundant user queries. See Banking Artificial Intelligence at its full potential with our Banking Virtual Assistant specifically designed for Banking and Fintech.

Chatbots are very well known for boosting customer satisfaction, simultaneously helping bank personnel to automate their day-to-day operations. This way bank staff can easily focus on tasks of greater importance. Over time, with the use of banking artificial intelligence, chatbots are more advanced than ever before. From just dealing with customers' predefined questions, new AI-powered conversational bots can now act as intelligent collaborators at work.

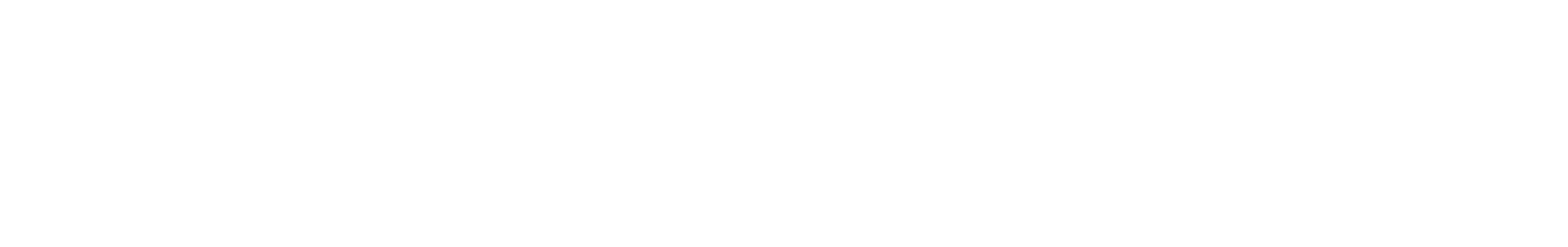

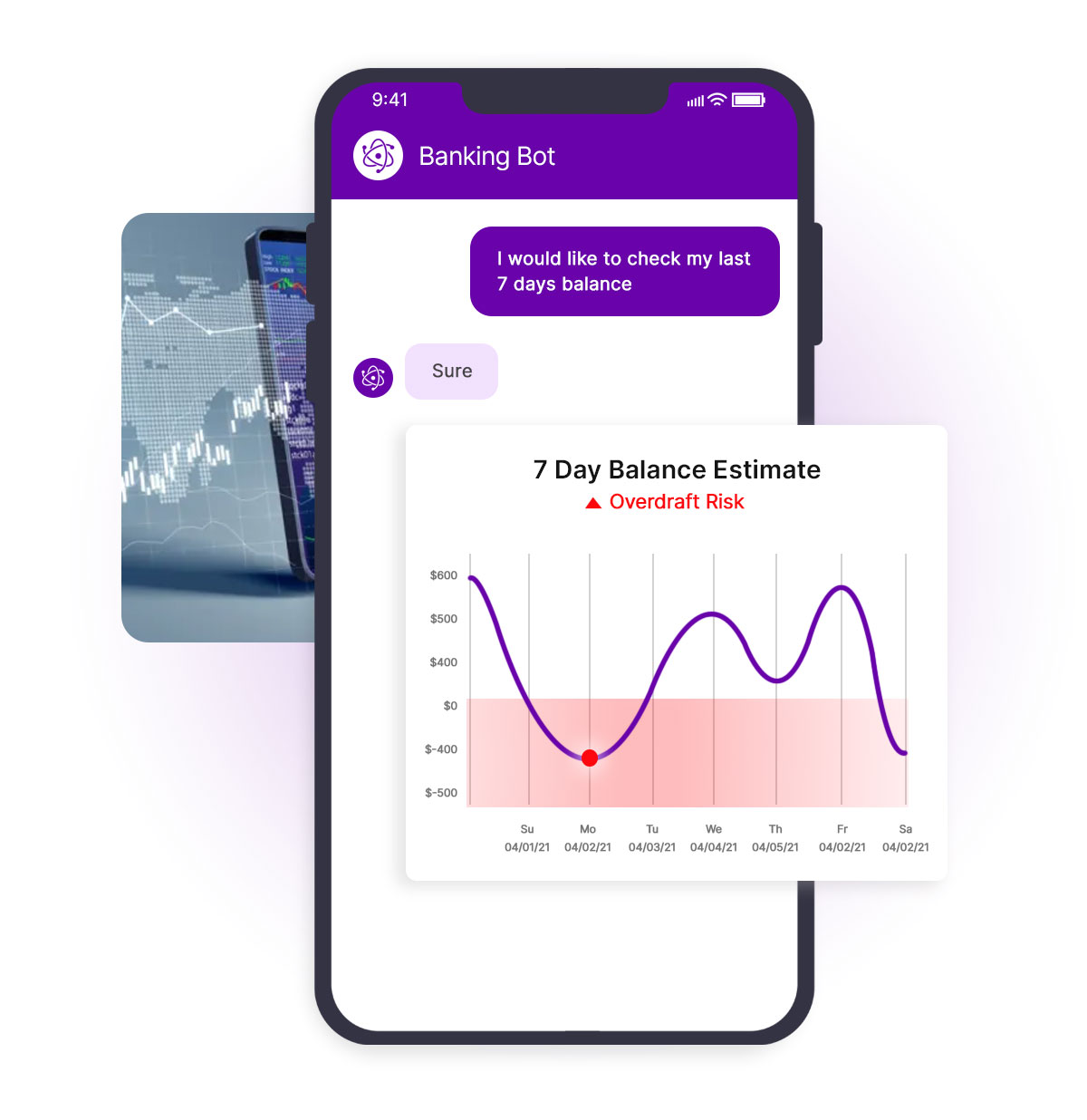

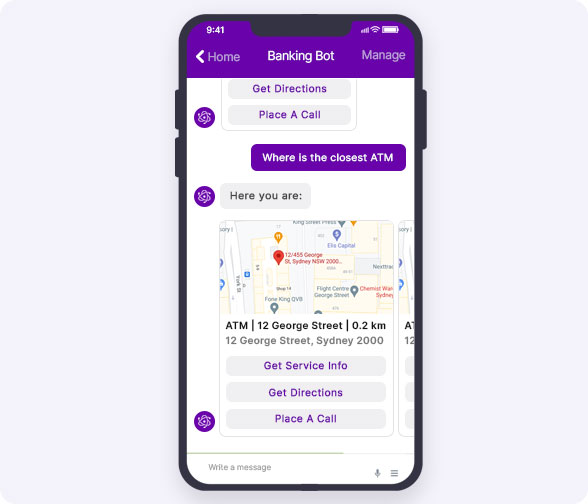

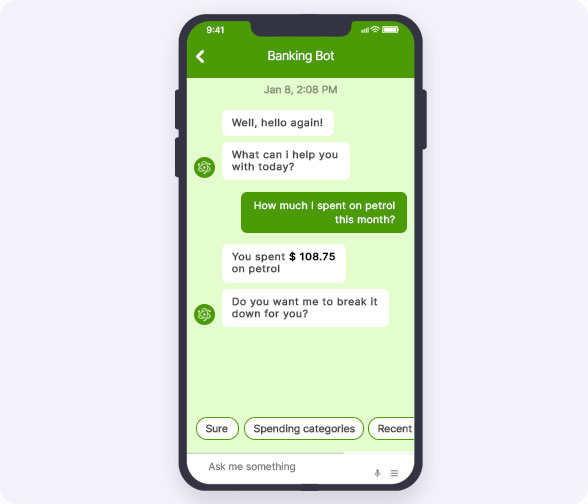

Customer Self-Service Banking Chatbot

With our AI-powered Banking Chatbots, customers can easily handle balance enquiries, update account information, quickly get access to intricate details, answer banking questions, block credit/debit cards, and so much more. Our Banking Chatbots lets your agents focus only on critical issues without worrying about the day-to-day monotonous customer queries.

Our smart AI powered chatbots offer a customized experience to all existing and prospective banking customers. The customers no longer have to visit banks regularly to keep a check on their account balance, update basic information like address, get monthly statements, or report missing cards. Our 24/7 available chatbots do everything for your customers at the comfort of their home, with no time constraints. This saves a lot of time and prompts a higher customer experience, leading to more business productivity.

Skyrocket Customer Onboarding with Banking Virtual Assistants

With increasing abandonment rates for bank account and loan applications due to agents following up on business days, your sales team needs banking artificial intelligence. The need for speed and quick problem resolving makes virtual banking assistants the need of the hour. Banking chatbots can easily set the banks on a path for years of success, letting them give importance to personalization in customer interactions.

- Customers get to experience a more fast-paced communication

- Solve the problems of your potential customers round-the-clock

- Switch from traditional banking to more intuitive and easy to use banking chatbots

- Your customers can now bid goodbye to tedious and slow chat interfaces with our all new smart banking chatbots

- Advanced AI-powered banking bots are relatively easy to maintain and cost effective

8 customer service processes banks should automate

Switch to Customer-Centric Banking

A banking service where the customer is in charge is the best kind of banking. Moreover, with advancement in technology, customers' expectations have persistently been advancing as of late. Regardless of having the access to advanced and application based web banking services, customers still look for solutions that eliminate the friction with ordinary banking.

As a matter of fact, 85% of buyers currently communicate with organizations even without addressing a human. So, more banking firms should invest in conversational banking strategy to deliver a customized customer experience. Banking chatbots are the future of banking as they can easily free up banking specialists to cater to more complex issues, while assisting customers more effectively. So, switch to a newer era of banking where chats are more advanced, personalized, and quick; making customers the driver of conversations.